Private Equity

Solutions

Holistic IT Solutions Securing & Creating Value

Our holistic lineup of solutions helps private equity firms manage their IT infrastructure, cybersecurity, Salesforce, and applications with confidence. Our comprehensive solutions are designed to streamline operations, reduce capital expenditures, ensure risk management and compliance, and deliver a higher return on investment.

Only 37% strongly agree that their IT team hasto conduct a cybersecurity assessment for an acquisition.

Protect Your Investment

Expert due diligence process minimizing security gaps

Speed to Market

Reduce TSA time and get to a run state before or within the timeline

Deeper Insights Into Your Investment

Look under the hood of IT operations, the engine of the business

CURRENT CYBER RISK LANDSCAPE IN M&A

“Cyber risk should be reviewed as part of the diligence process to uncover red flags that could potentially be otherwise undiscovered until after a deal closes. This should be overseen by a team with business, operations, and IT experience to ensure a comprehensive understanding of how the target business operates and the various reasons they may fall into an unseemly security situation.”

2023 Private Equity Outlook | Read the full report

%

agreed their company faces significant cybersecurity risk acquiring new companies, and cyber risk is their biggest concern post-acquisition

%

report their organization has encountered a critical cybersecurity issue or incident during an M&A deal that put the deal into jeopardy

%

said their companies experienced regrets in making an M&A deal due to cybersecurity concerns

I.T. CONSIDERATIONS BY DEAL STAGE

M&A Readiness

A comprehensive assessment should be conducted to identify any gaps or vulnerabilities in order to determine the necessary changes needed to ensure data security and compliance. A review of existing contracts and arrangements with external vendors should also be conducted to ensure that the services provided meet the organization‘s needs. Finally, it is important for organizations to have an incident response plan in place in case of a data breach or cyber attack.

Ascend provides insightful analytics and system scans to find red flags followed by risk and advisory consulting.

Acquisition

The first stages of IT evaluation and due diligence when buying a company include reviewing the target company’s financials, IT infrastructure, IT systems, and cybersecurity policies. Conducting a valuation analysis of the IT assets and ensuring that any changes or upgrades to the systems are noted in the agreement should be considered. Oftentimes due diligence is focused on the financial aspect of the acquisition. In reality, IT is the organization’s engine and needs to be thoroughly analyzed before purchase announcements are made to ensure uptime & minimize cyber threats.

Ascend provides IT migration and consolidation solutions to enable successful TSA completion.

Holding & Value Creation

The holding stage of a private equity investment presents an opportunity to add value to the company that was acquired. Through strategic initiatives, operational improvement, and investment in technology, cybersecurity, and people, the right private equity firm can secure and unlock significant value for the business.

Ascend sets you up for ongoing operation excellence with an optimized and secure run-state through checks and balances.

Carve-out

IT and cybersecurity considerations during carve–outs are especially important due to the split of resources between companies. Proper planning is needed to ensure that any shared infrastructure or services remain operational. In addition, proper onboarding and access rights need to be established for personnel in order to maintain data security and privacy. Finally, risk assessments should be conducted to identify areas of potential vulnerabilities or risks so that they can be mitigated.

Ascend establishes a division of IT assets and risk assessments to ensure a smooth transition.

Exit

The technology and cybersecurity strategies during the selling stage are essential for success. IT investments should be made to upgrade infrastructure and systems, while also keeping up with changing security needs. Policies and procedures should be in place to ensure that the company is appropriately protected from cyberattacks and data breaches. Finally, ongoing due diligence and risk assessment must be conducted to identify potential risks and vulnerabilities so that any necessary measures can be taken to protect the business and increase valuation.

Ascend handles risk, migrations, optimization, and standardization to ensure the business is valuable and can run on it’s own.

I.T. CONSIDERATIONS BY DEAL STAGE

How Private Equity Firms are Staying Ahead of Digital Transformation to Maximize Value

Are you realizing the full value creation opportunity from your portfolio companies?

Private Equity is moving faster than ever and there’s more competition and uncertainty. Information technology is central to doing business today and the landscape is constantly changing while getting ever more complex. Digital transformation is on the tips of everyone’s tongues and yet it is perfectly unclear what it means for value creation to most private equity managing partners. Whether your next transaction is buy-side, sell-side, a carve out or a merger, understanding the risks and rewards that come with every investment move is crucial to positive financial results. Being confident in the technology due diligence and gaining economies of scale and synergies across your portfolio companies (portcos) decreases costs and increases profits.

These are the questions managing partners need to be asking themselves today…

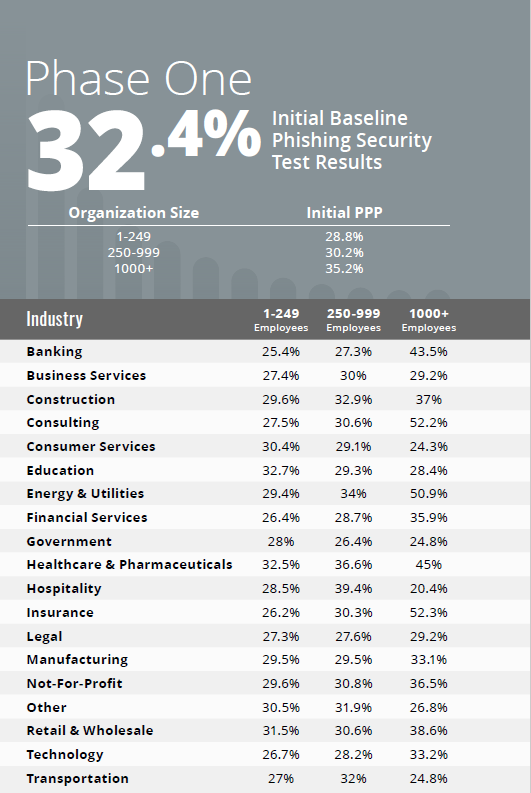

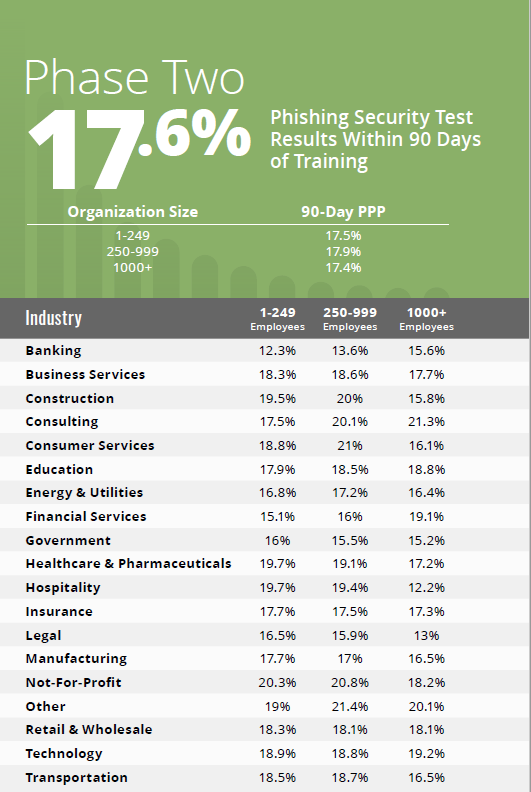

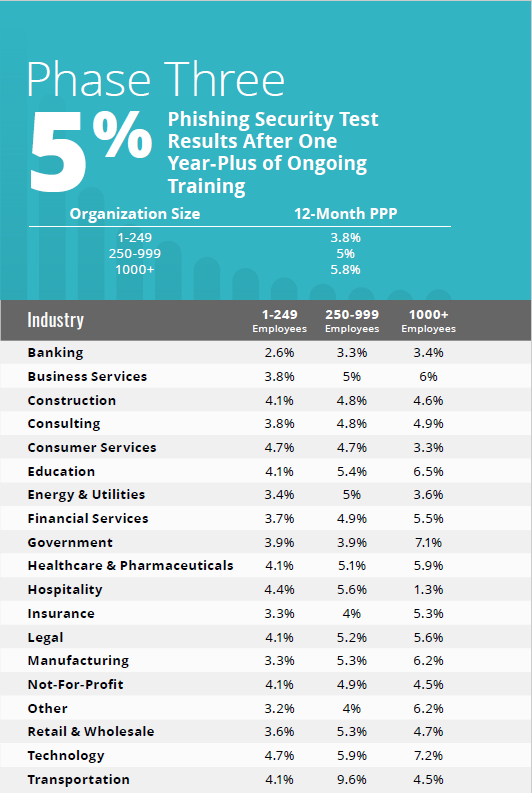

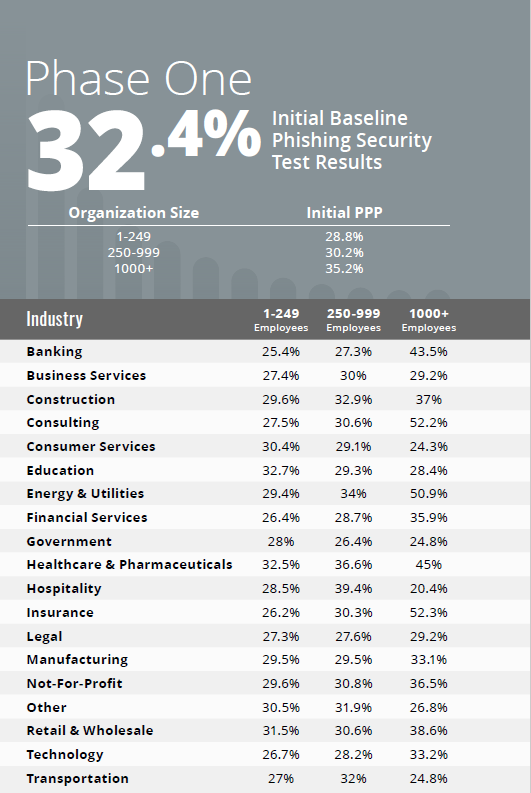

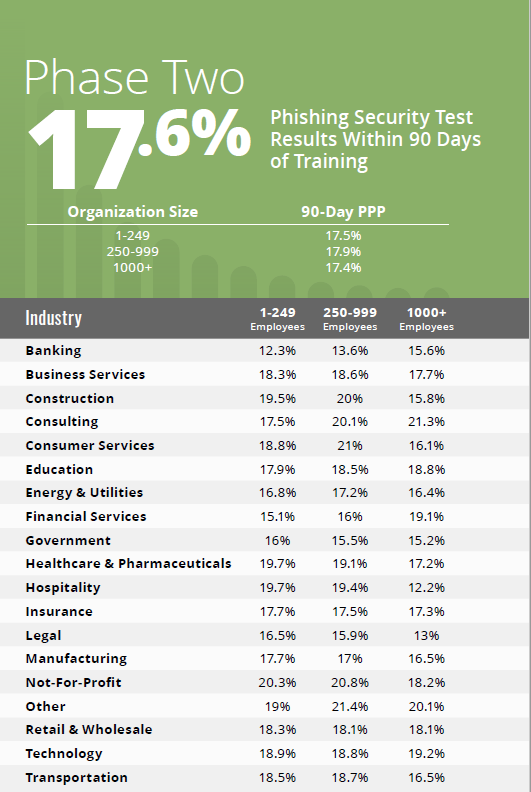

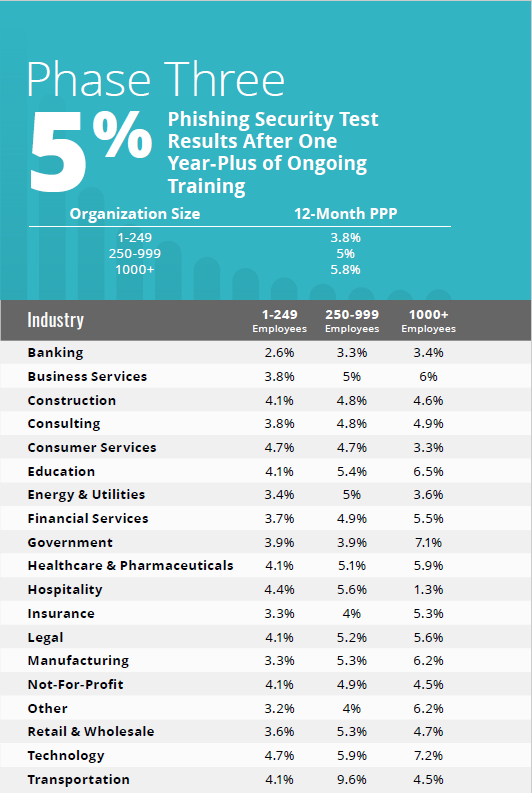

How do your portcos stack up against phishing?

%

average improvement rate across all industries and sizesof ongoing phishing & security awareness training

%

average improvement rate across all industries and sizesof ongoing phishing & security awareness training

According to Tech Republic, the number of ransomware attacks increased by 105% in 2021, equating to over 623 million attacks worldwide.

With the ongoing surge in cybercrimes, private equity (PE) firms risk becoming part of an alarming statistic if they continue to ignore the effects of limited (or nonexistent) security. To better understand why private equity firms are at risk, the damages that are on the line, and how to ensure better protection moving forward, read on.

schedule a free consultation

If you are looking for an experienced team that understands your industry and understand what it takes to enable your success, let’s talk. Set up a free initial consultation.

schedule a free consultation

If you are looking for an experienced team that understands your industry and understand what it takes to enable your success, let’s talk. Set up a free initial consultation.

Continue Exploring